oregon wbf tax rate 2020

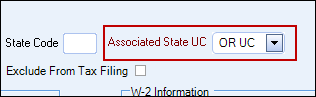

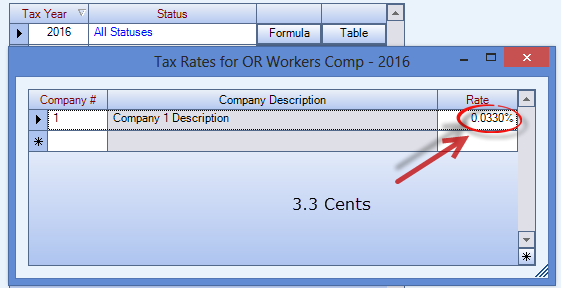

Box 4D Use the current LTD tax rate. Select the Other tab.

Double-click the employees name.

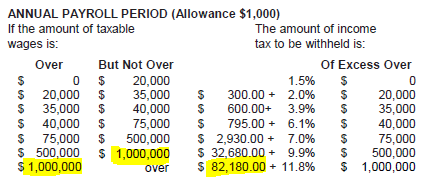

. The 2022 payroll tax schedule is a modest shift down from the 2021 tax schedule with an average rate of 197 percent on the first 47700 paid to each employee. Outlook for the 2023 Oregon income tax rate is to remain unchanged with the lower three income tax brackets increasing due to the annual inflation adjustment. 1 2019 Oregons unemployment-taxable wage base is to be 40600 up from 39300 for 2018 the state Employment Department said Nov.

Oregon has an additional requirement of Form OR-WR Oregon Annual Withholding Tax Reconciliation Report to be filed only if there is a tax. Married Filing Jointly Tax Brackets. QB incorrectly adds vacation hours and holiday hours to calculate this assessment.

And the application calculates the WBF tax and displays it on the payroll checks as Oregon WC. Wbf assessment for Oregon is based on the number of hours that an employee works. 21 in a news release.

The chart below breaks down the Oregon tax brackets using this model. Help users access the login page while offering essential notes during the login process. The Oregon Workers Benefit Fund WBF.

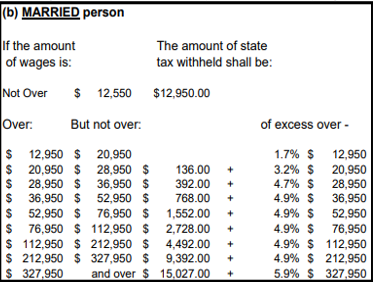

All regular overtime and double time hours are. The detailed information for Oregon Wbf Assessment Rate 2020 is provided. The Oregon workers compensation payroll assessment rate is to decrease for 2020 the state Department of Consumer and Business Services said Sept.

The oregon 2021 state unemployment insurance sui tax rates range from 12 to 54 on rate schedule iv up from 07 to 54 on rate schedule ii for 2020 and 09 to 54 on rate. The combination of the changes to all of the workers compensation rates for 2020 will result in the average employer paying 102 per 100 of payroll for claims costs and. The oregon 2021 state unemployment insurance sui tax rates range from 12 to 54 on rate schedule iv up from 07 to 54 on rate schedule ii for 2020 and 09 to 54 on rate.

Go to Employees then Employee Center. For earnings between 000 and 355000 youll pay 5. Select Taxes to display the Federal State and Other tabs.

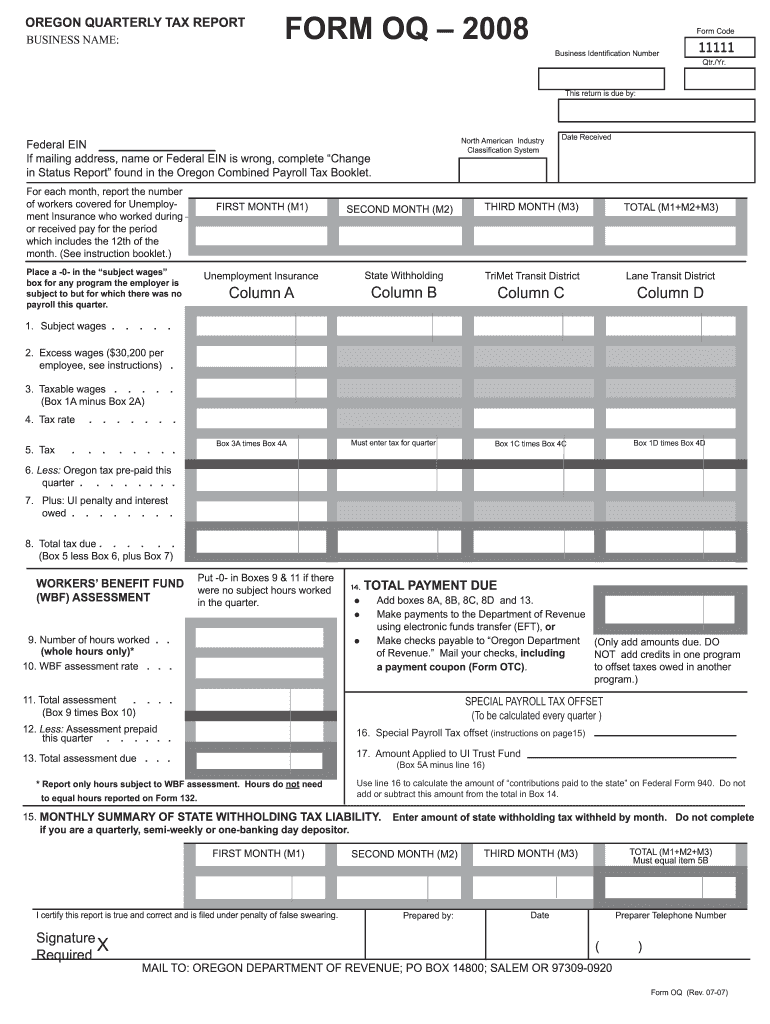

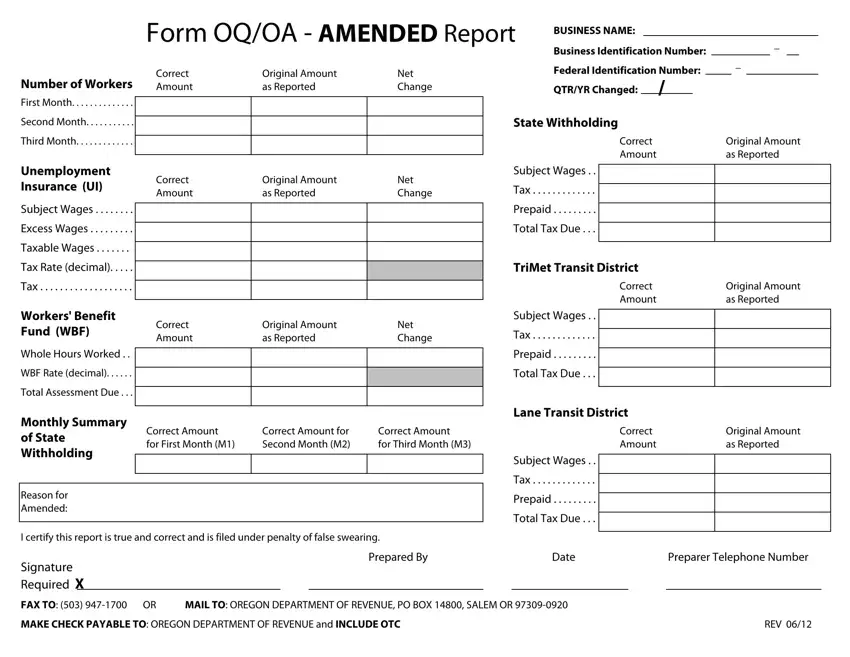

Oregon Oq Form 2020 Fill And Sign Printable Template Online

Oregon Business Development Department State Of Oregon

Form Oq Fill Out Printable Pdf Forms Online

Workers Compensation Request For Reimbursement Of Expenses Oregon Fill Out Sign Online Dochub

Workers Compensation Request For Reimbursement Of Expenses Oregon Fill Out Sign Online Dochub

Oregon Workers Benefit Fund Payroll Tax

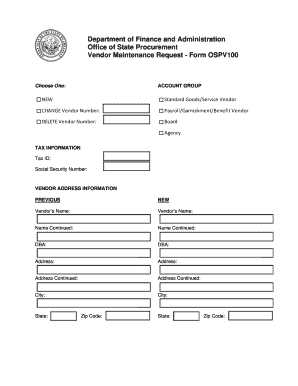

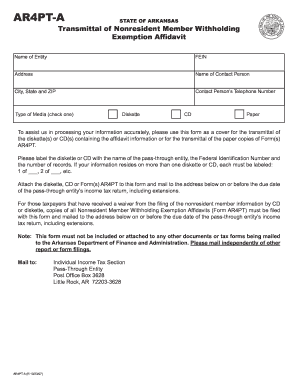

Oregon Payroll Tax And Registration Guide Peo Guide

Workers Compensation Request For Reimbursement Of Expenses Oregon Fill Out Sign Online Dochub

Department Of Consumer And Business Services Charts Oregon Workers Compensation Costs State Of Oregon

The Gaming And Decline Of Oregon Corporate Taxes Oregon Center For Public Policy

Oregon Workers Benefit Fund Payroll Tax

Oregon Payroll Tax And Registration Guide Peo Guide

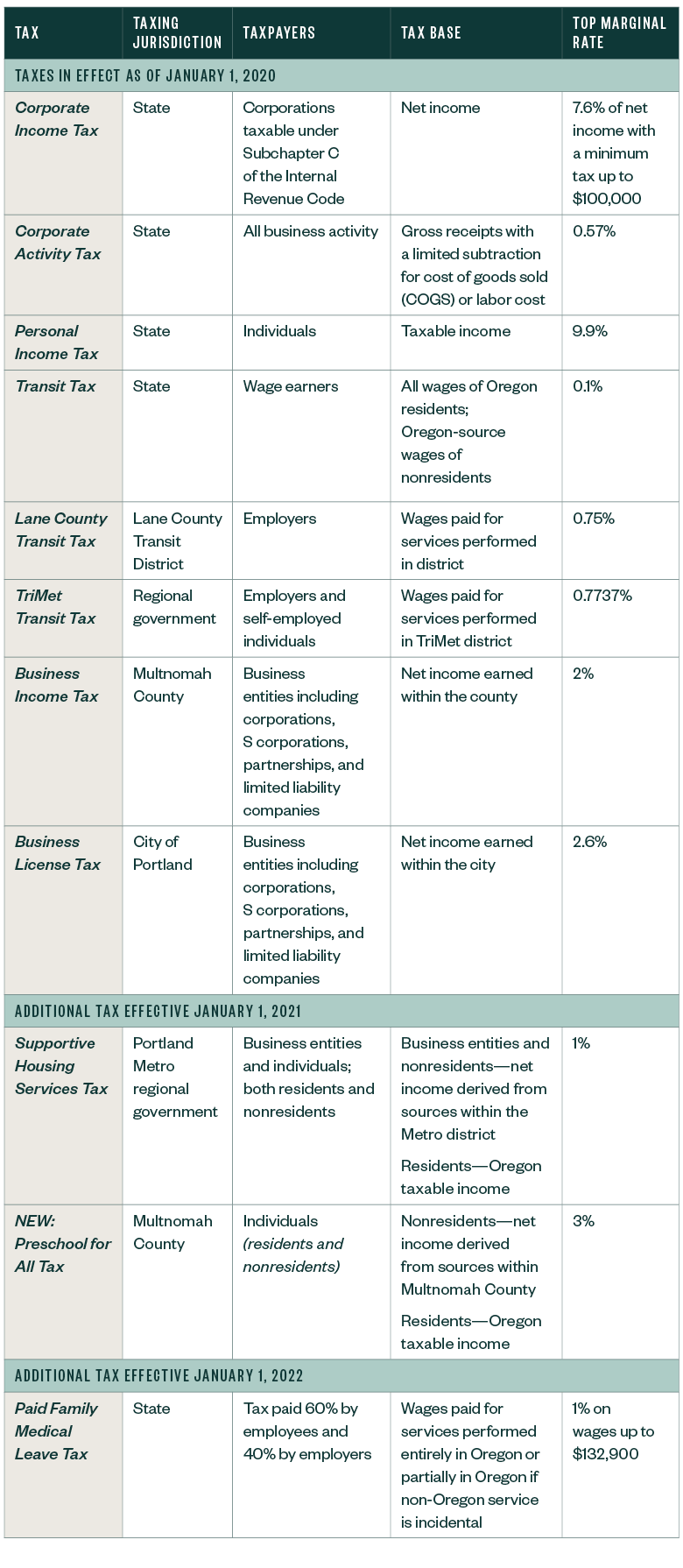

New Portland Tax Further Complicates Tax Landscape

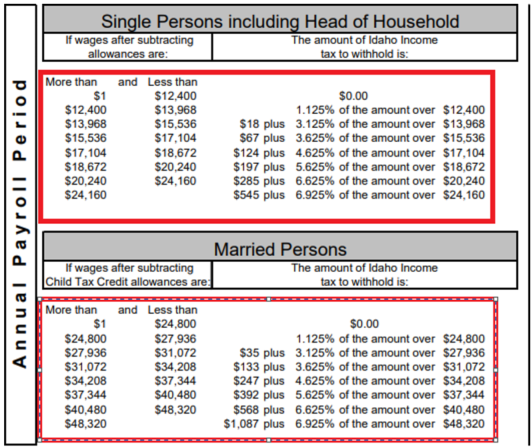

Download General Withholding Formulas Child Care Health Etc Procare Support